Java Online Training In Andhra Pradesh and Telangana

Java Online Training In Andhra Pradesh and Telangana

Opening Hours :7AM to 9PM

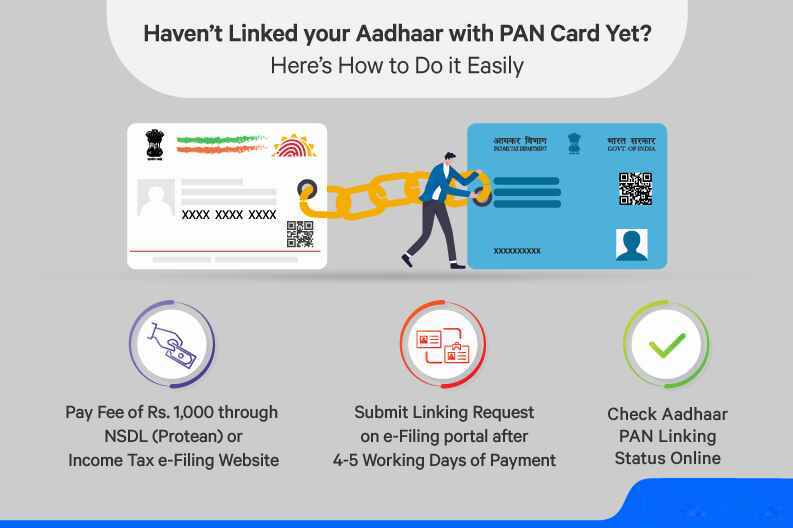

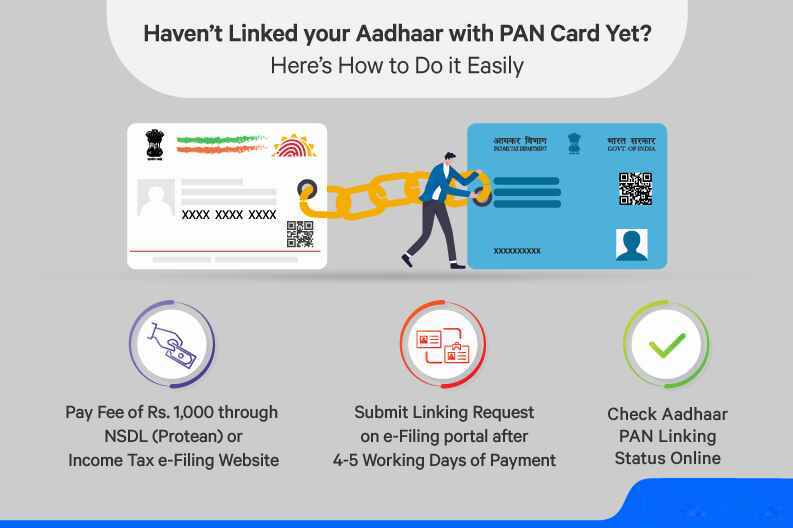

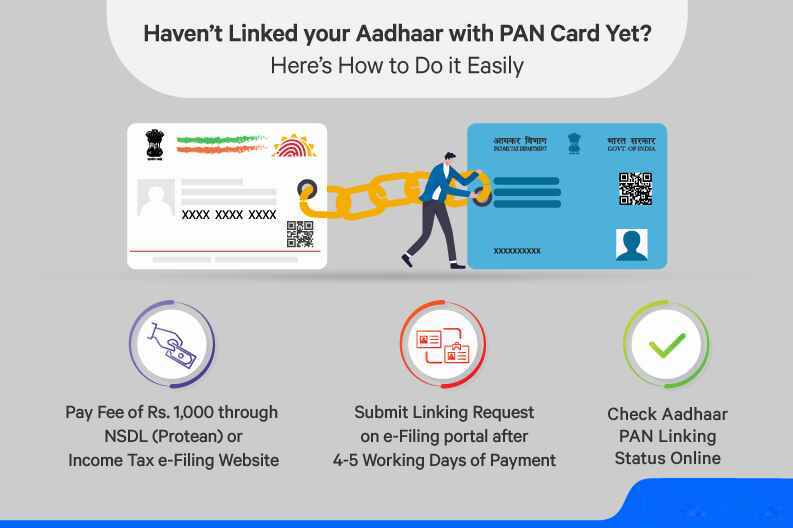

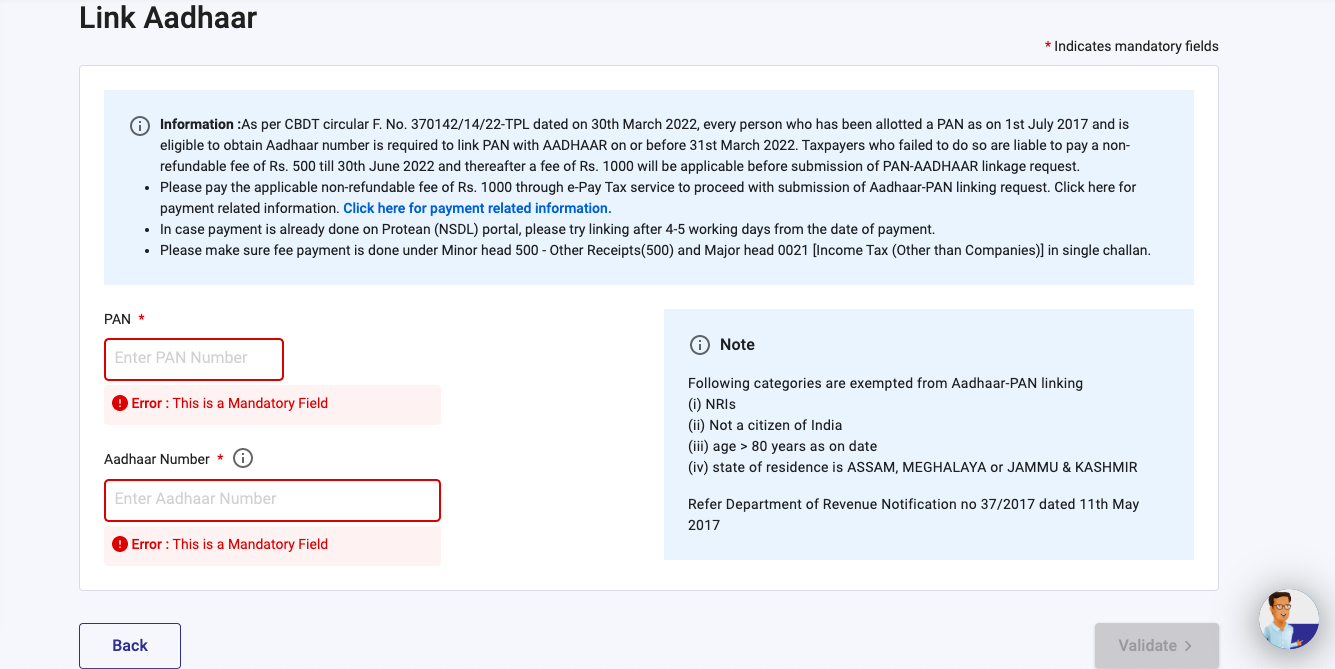

PAN Aadhaar Linking Check

PAN Aadhaar Linking Check?

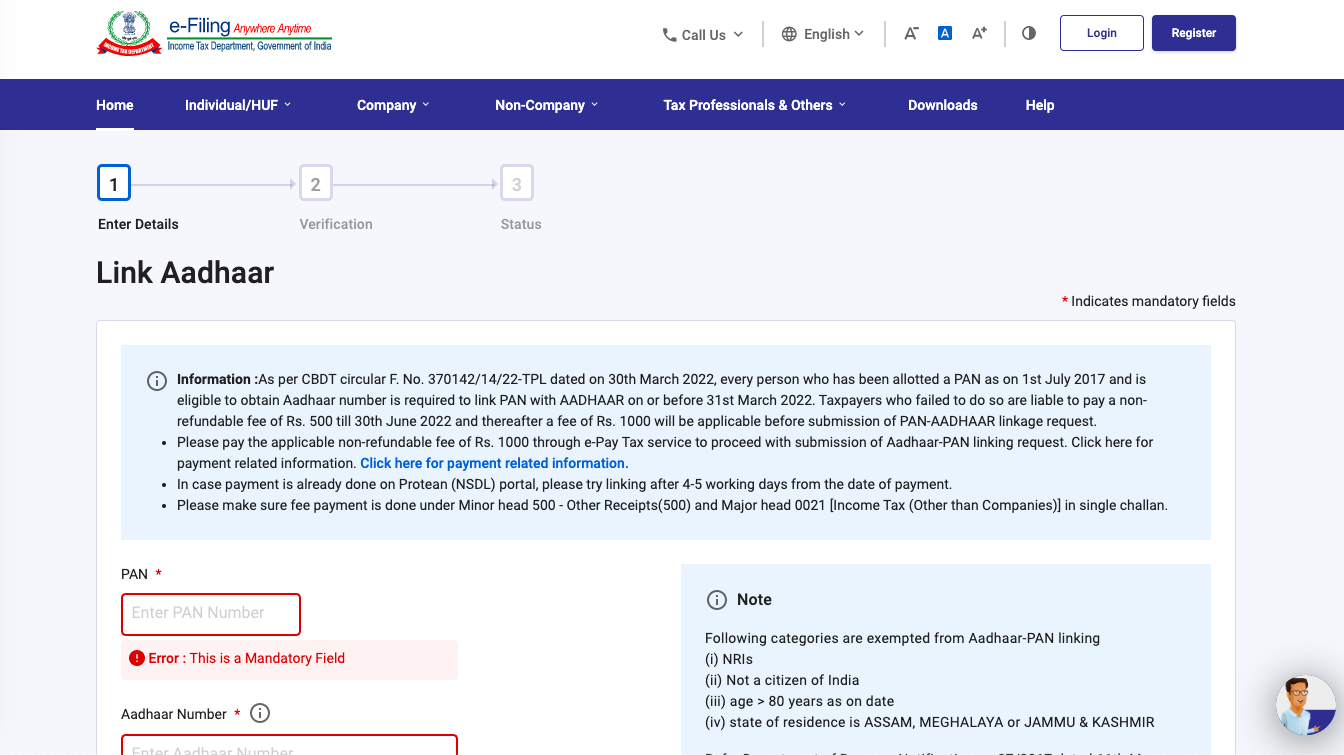

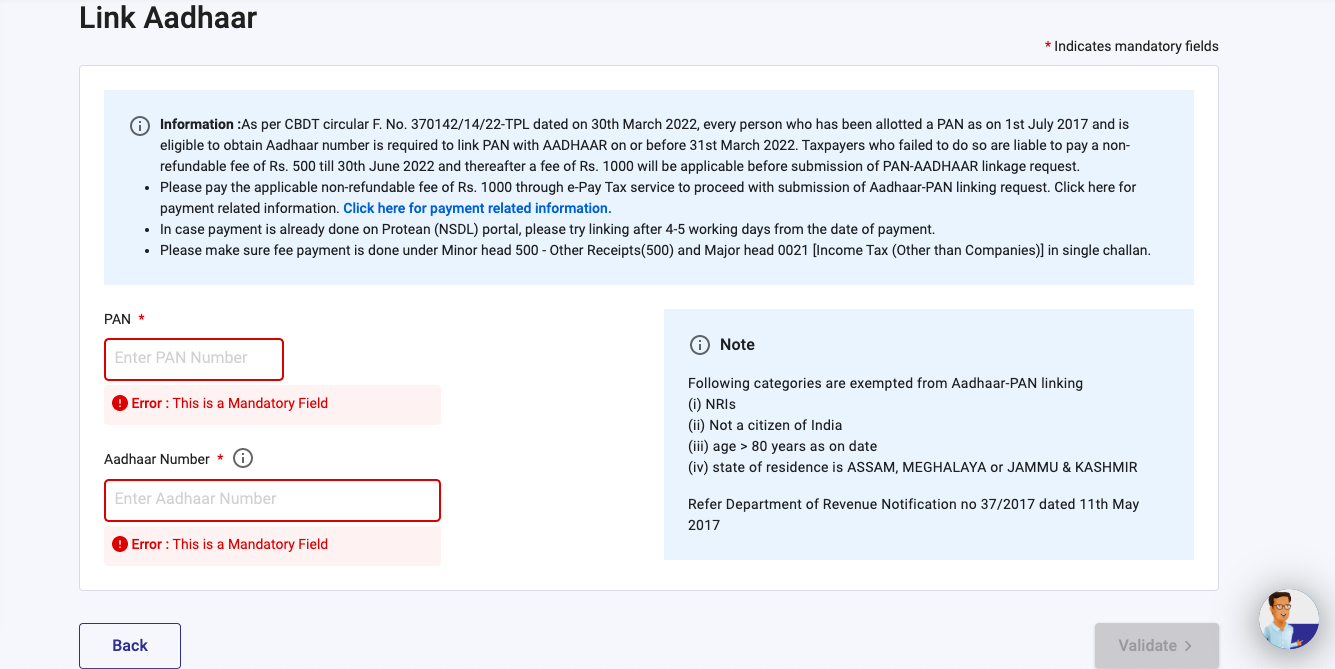

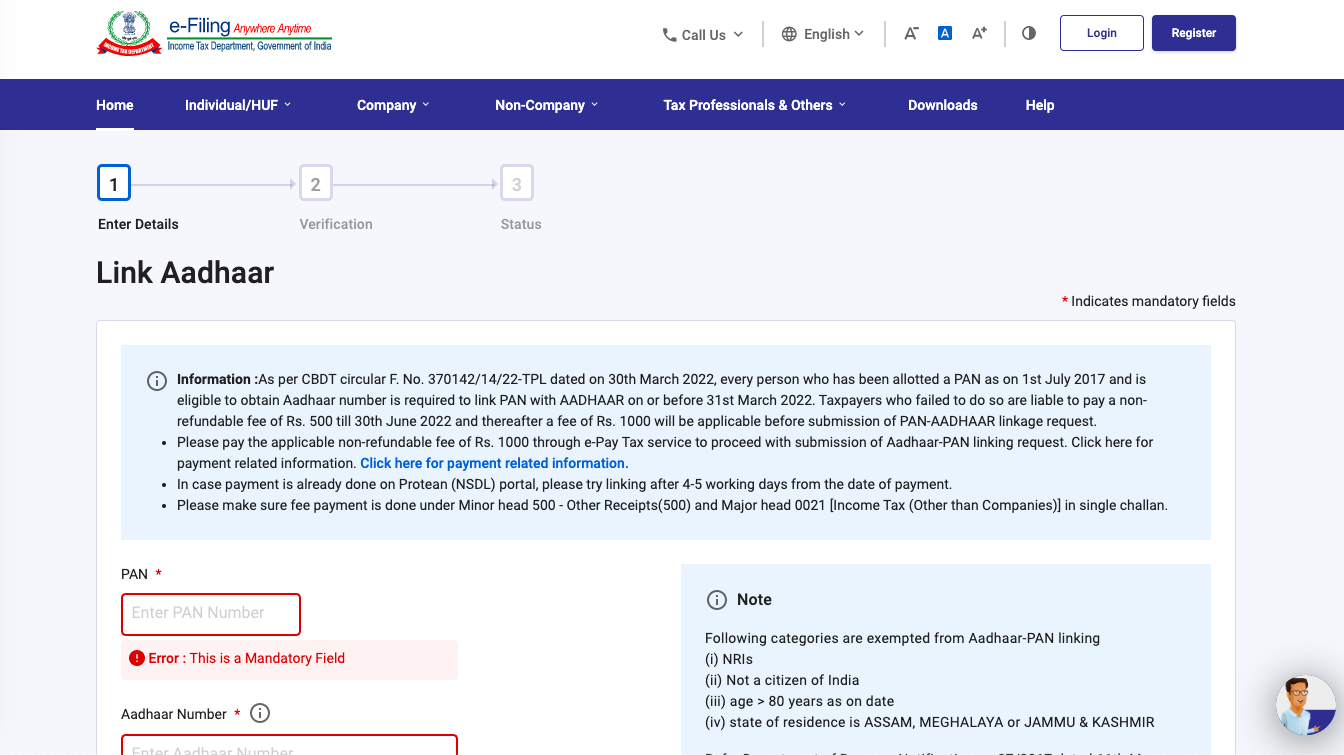

1. Applicant can link Aadhaar with PAN using the link

Link Aadhaar (https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar) through E-filing website

2. If you have Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, City Union Bank, Federal Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Jammu & Kashmir Bank, Karur Vyasa, Kotak Mahindra Bank, Punjab National Bank, UCO Bank, Union Bank of India accounts, please follow below steps:

3. Provide your PAN, Confirm PAN and Mobile number to receive OTP

4. Post OTP verification, you will be redirected to a page showing different payment tiles

5. Click Proceed on the Income Tax tile

6. Select AY as 2023-24 and Type of Payment - as other Receipts (500) and Continue

7. Enter the amount as Rs. 1000 under 'Others' field in tax break-up and proceed with further steps

8. If you have Other bank account (bank is not listed for payment through e-Pay tax), please follow below steps

9. Click on hyperlink ‘Click here to go to NSDL (Protean) tax payment page for other banks’ given below on e-Pay tax page to redirect to Protean (NSDL) portal

10. Click Proceed under Challan No./ITNS 280

11. Select (0021) Income Tax (Other than Companies) under Tax Applicable (Major Head)

12. Select (500) Other Receipts) under Type of Payment (Minor Head)

13. Select AY as 2023-24, provide other mandatory details and Proceed

14. Payment Verification Method:

15. Taxpayer will receive challan receipt on successful payment. User can also check bank account statement to ensure if amount was deducted or not.

16. Taxpayer can check challan status through challan status enquiry by providing BSR code, challan date and serial number on https://tin.tin.nsdl.com/oltas/index.html

17. Challan details will also get updated in form 26AS in 4-5 working days.

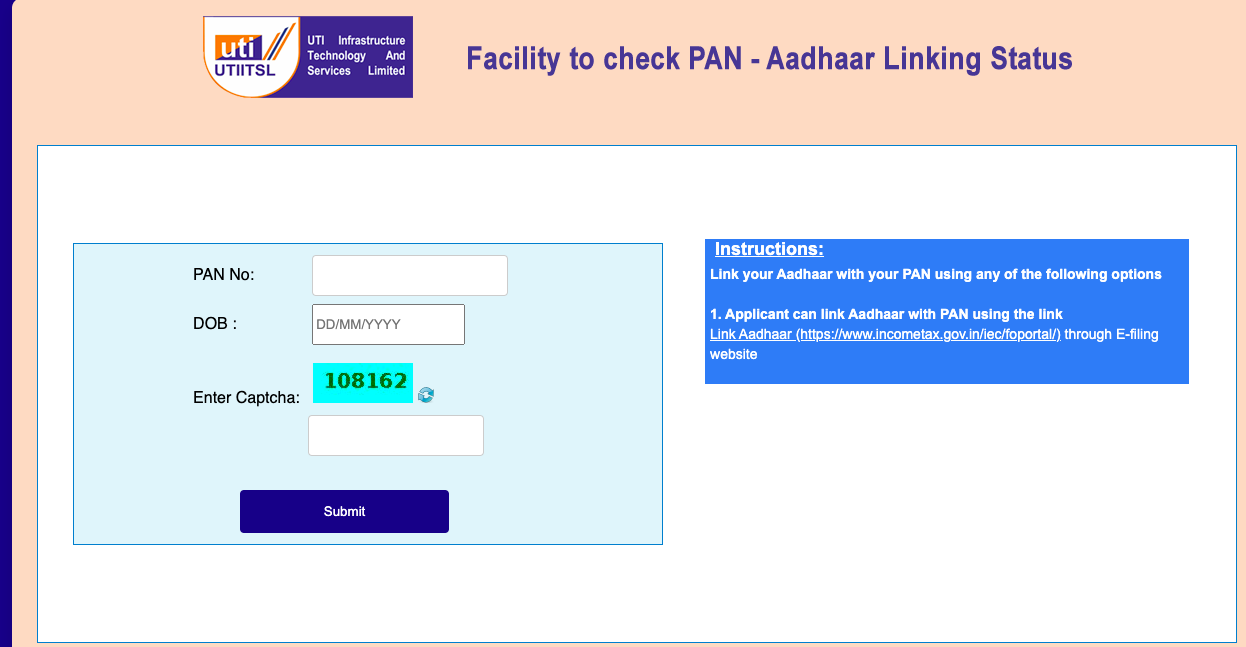

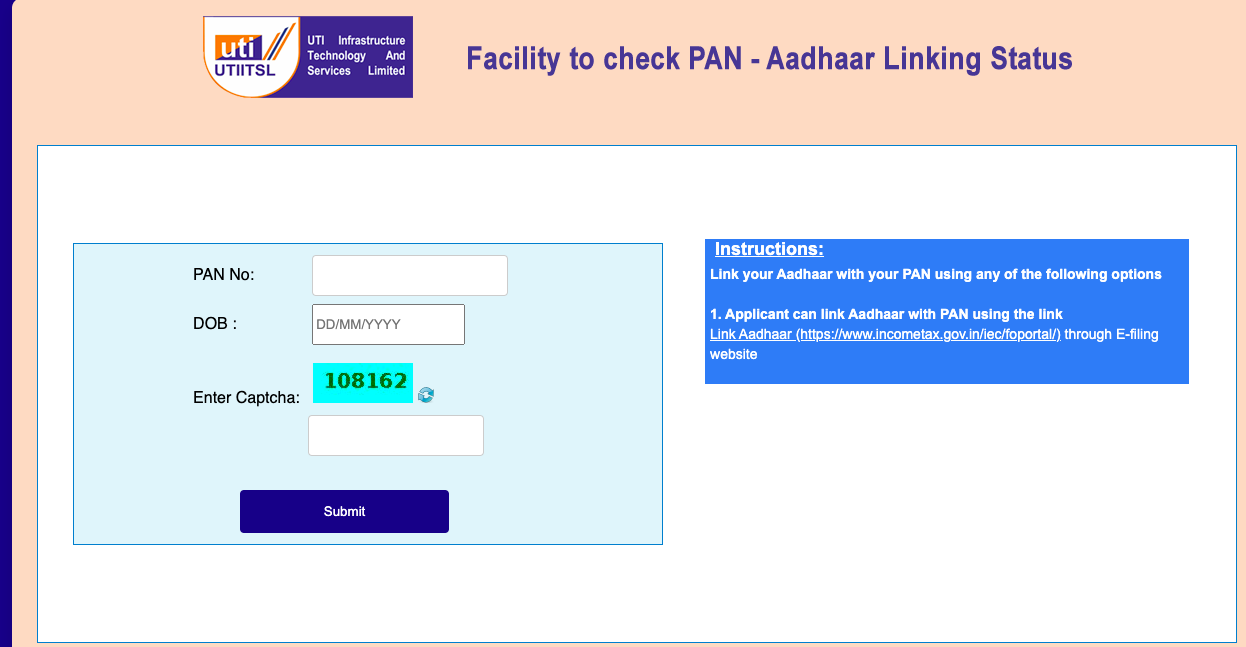

PAN Aadhaar Linking Check

https://www.pan.utiitsl.com/panaadhaarlink/forms/pan.html/panaadhaar

Instructions:

Link your Aadhaar with your PAN using any of the following options1. Applicant can link Aadhaar with PAN using the link

Link Aadhaar (https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar) through E-filing website

Payment related information

1. The fee payment for PAN-Aadhaar Linkage need to be made through e-Pay Tax functionality available on e-filing Portal.2. If you have Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, City Union Bank, Federal Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Jammu & Kashmir Bank, Karur Vyasa, Kotak Mahindra Bank, Punjab National Bank, UCO Bank, Union Bank of India accounts, please follow below steps:

3. Provide your PAN, Confirm PAN and Mobile number to receive OTP

4. Post OTP verification, you will be redirected to a page showing different payment tiles

5. Click Proceed on the Income Tax tile

6. Select AY as 2023-24 and Type of Payment - as other Receipts (500) and Continue

7. Enter the amount as Rs. 1000 under 'Others' field in tax break-up and proceed with further steps

8. If you have Other bank account (bank is not listed for payment through e-Pay tax), please follow below steps

9. Click on hyperlink ‘Click here to go to NSDL (Protean) tax payment page for other banks’ given below on e-Pay tax page to redirect to Protean (NSDL) portal

10. Click Proceed under Challan No./ITNS 280

11. Select (0021) Income Tax (Other than Companies) under Tax Applicable (Major Head)

12. Select (500) Other Receipts) under Type of Payment (Minor Head)

13. Select AY as 2023-24, provide other mandatory details and Proceed

14. Payment Verification Method:

15. Taxpayer will receive challan receipt on successful payment. User can also check bank account statement to ensure if amount was deducted or not.

16. Taxpayer can check challan status through challan status enquiry by providing BSR code, challan date and serial number on https://tin.tin.nsdl.com/oltas/index.html

17. Challan details will also get updated in form 26AS in 4-5 working days.

10000Rs

10000Rs

10000Rs